We adhere to strict editorial integrity standards to help you make decisions with confidence. Some or all of the links included in this article are paid links.

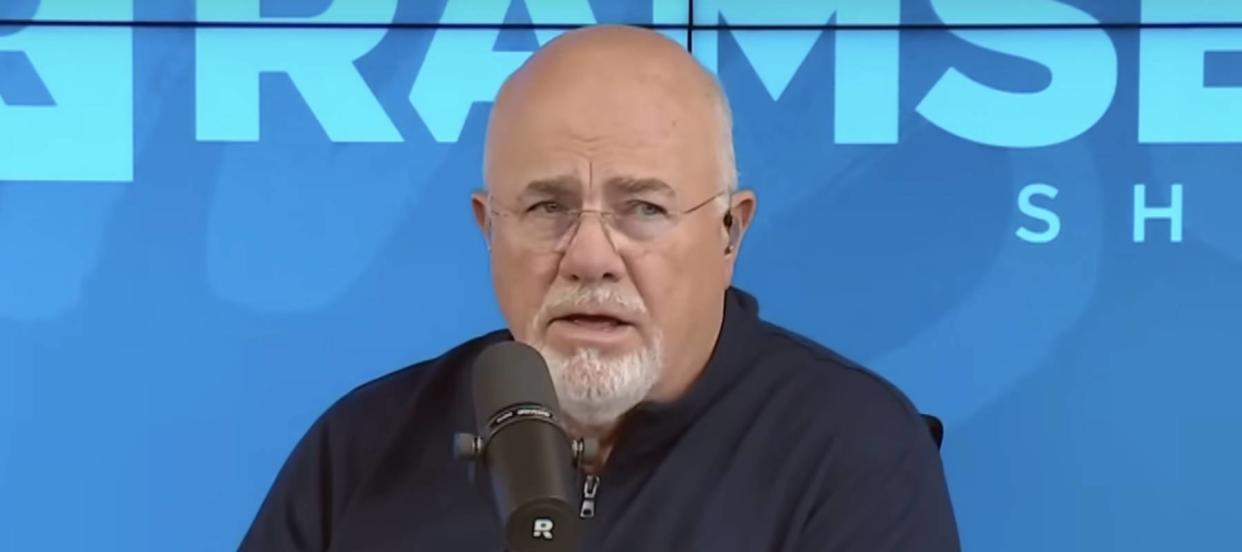

Over 32 years of providing financial advice on the airwaves, Dave Ramsey has probably seen it all. But on a recent episode of “The Ramsey Show,” he points out financial mistakes callers frequently make that can be described as “dumb! Really dumb!”

He added: “These things baffle me, that’s why I criticize them,” he said. “Because they are simply illogical.”

However, some argue that economic and social trends may have made some of these mistakes inevitable. Below, we take a closer look at three of the top “dumb” money mistakes Ramsey mentions and why they are so common.

Do not miss it

-

These 5 magical money moves will propel you up the U.S. net worth ladder in 2024, and you can complete each step in a matter of minutes. Here’s how

-

“You didn’t want to take any chances”: An 80-year-old South Carolina woman is looking for the safest place for her family’s $250,000 savings. Here’s Dave Ramsey’s response

-

Car insurance premiums in the United States are sky-high and only getting worse. But with 5 minutes you could pay as little as $29 a month

1. Joint purchase of a property

Ramsey loathes the prospect of buying property with someone other than your spouse and advises against the practice even in long-term relationships.

This advice is based on the fact that the separation of property between an unmarried couple can be complicated, since they do not always share the same property rights as married couples.

However, the housing crisis has pushed more people to consider co-owning a property. A report by Co-Buy, a platform that helps multiple buyers share a property, says that 26.7% of home purchases in 2023 were joint purchases, while 30% of those joint purchases were made by unmarried couples.

If you are not in a position to purchase a home, whether alone or with your spouse, you can still take advantage of the income-generating potential that real estate offers.

One way you can benefit from the hot US rental market in particular is through Arrived.

Backed by world-class investors like Jeff Bezos, Arrived allows investors to purchase shares in rental homes and vacation rentals without taking on the similar responsibilities of direct home ownership and property management.

Start by exploring a curated selection of homes, vetted for appreciation and income potential.

Once you find a property you like, you can start investing with as little as $100, a price that may seem more attractive than that associated with owning and managing a property yourself.

Investing directly in specific properties is not the only accessible way to take advantage of the passive income potential of real estate.

Real estate investment trusts (REITs) are public and private companies that acquire and manage portfolios of real estate properties (of various asset classes) and pay a percentage of the properties’ income to investors in the form of dividends.

Fundrise allows you to invest in their exclusive eREITs with an affordable minimum investment amount of $10.

Fundrise eREITs are designed to take advantage of the consistent income-generating potential of private real estate and deliver dividends quarterly. They also create a portfolio and allocate portions to a mix of eREITs so your account fits your risk tolerance and goals.

Read more: “It’s not taxed at all”: Warren Buffett shares the “best investment” you can make when battling rising costs – take advantage today

2. Excessive spending on education

Ramsey believes that investing in education should yield higher returns. Otherwise, it is a useless investment.

“Don’t spend $250,000 to get a master’s degree in sociology so you can work as a social worker for the state and make $38,000,” he said.

He believes students should realistically consider their career prospects and future earnings before going into debt to pay for college.

You can also minimize the impact of paying for education by saving early (either for yourself or your children) through a high-interest savings vehicle, such as a certificate of deposit or other high-yield savings account.

A certificate of deposit (CD) pays a fixed interest rate on money held for a set period of time. CD rates are typically higher than other savings accounts, but if you withdraw funds from your CD early, you will be charged a penalty.

But since this is a long-term savings strategy for your or your child’s education, they’re a solid option that you won’t be as tempted to turn to.

For a limited time, you can save even more with Synchrony Bank’s 13-month CD, which offers a 5.15% annual percentage yield (APY). That’s more than double the national average APY of 1.8% for a 1-year CD, according to Bankrate.

To get started, simply create an account, select the 13-month CD product, and add the amount you want to deposit. For those who already have student debt, it can be a daunting task to tackle. Americans collectively have $1.6 trillion in student loan debt.

If you find yourself in this situation, it is possible to make that mountain of debt more surmountable by refinancing your student loans. Through Credible’s online marketplace of approved lenders, you can search for the best personal loan rates for you and choose to consolidate your student debt.

With interest rates as low as 4.4% and repayment terms ranging from 24 to 84 months, you have time and flexibility.

3. Upgrade cars

Ramsey says a wrecked car is no reason to upgrade.

“You were driving a $6,000 car,” he said. “Your car gets totaled, you get a check for $6,000, and all of a sudden $6,000 cars aren’t good enough for you. That’s bullshit!”

However, the high cost of vehicles could make this financial mistake difficult to avoid. The average cost of a new car in May was $48,389, according to Kelley Blue Book, while the average sale price of a used car was $25,670.

If you’re concerned about the cost of a new or used car, you can save on car expenses by finding better car insurance rates at Bestmoney.com

Simply fill out a little information about yourself and your car, and BestMoney will generate a list of the most affordable car insurance options near you so you can make sure you get the lowest price for the coverage you need.

What to read next?

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.