Ford CEO Jim Farley made a rather controversial statement in a recent interview:

We need to start falling in love with smaller vehicles again. It’s very important for our society and for the adoption of electric vehicles. We’re in love with these gigantic vehicles and I love them too, but the main problem is the weight.

This strikes us as a bit ridiculous. Remember, Ford used to sell small sedans and hatchbacks here in the U.S., but decided to stop making them in favor of more profitable pickup trucks, crossovers, and SUVs. As a result, buyers gravitate toward what’s popular, so if Ford’s CEO really wants to know why Americans have “fallen out of love” with smaller vehicles, he might want to take a look at his company.

Recent economic conditions, including high gas prices and inflation, make it easy to want smaller cars – in fact, we think it’s a matter of common sense. However, in the consumer’s hour of need, none of the Big Three American automakers are ready to answer the call. Ford isn’t the only manufacturer that has sacrificed smaller cars, as Stellantis and Chevrolet don’t exactly have the upper hand in this regard either. Perhaps discontinuing small models was a short-sighted decision that all automakers will soon regret.

Ford killed the best small cars

Ford sold a number of small cars over the decades, including the Pinto, Escort and others, leading up to the Fiesta and Focus, which were sold in both sedan and hatchback body styles. Enthusiasts fondly remember the Ford Fiesta ST, Ford Focus ST and Focus RS as sporty, manual-transmission hatchbacks that offered superior performance to their Japanese and European counterparts at a lower price. Sadly, these cars disappeared along with their respective brands, remaining in Europe for a few more years.

Related

US Ford Focus Generations Ranked by Reliability

If you’re looking for a used Ford Focus, we’ve discovered the most reliable models.

While the later Fiestas and Focuses sold in Europe were quite attractive, non-ST models in the US were plagued by problems with their PowerShift dual-clutch transmissions. Ford was forced to pay millions of dollars in a class-action lawsuit due to recurring juddering, gear shift delays, and even unintended acceleration and deceleration. Despite these problems, the Fiesta and Focus sold in large numbers.

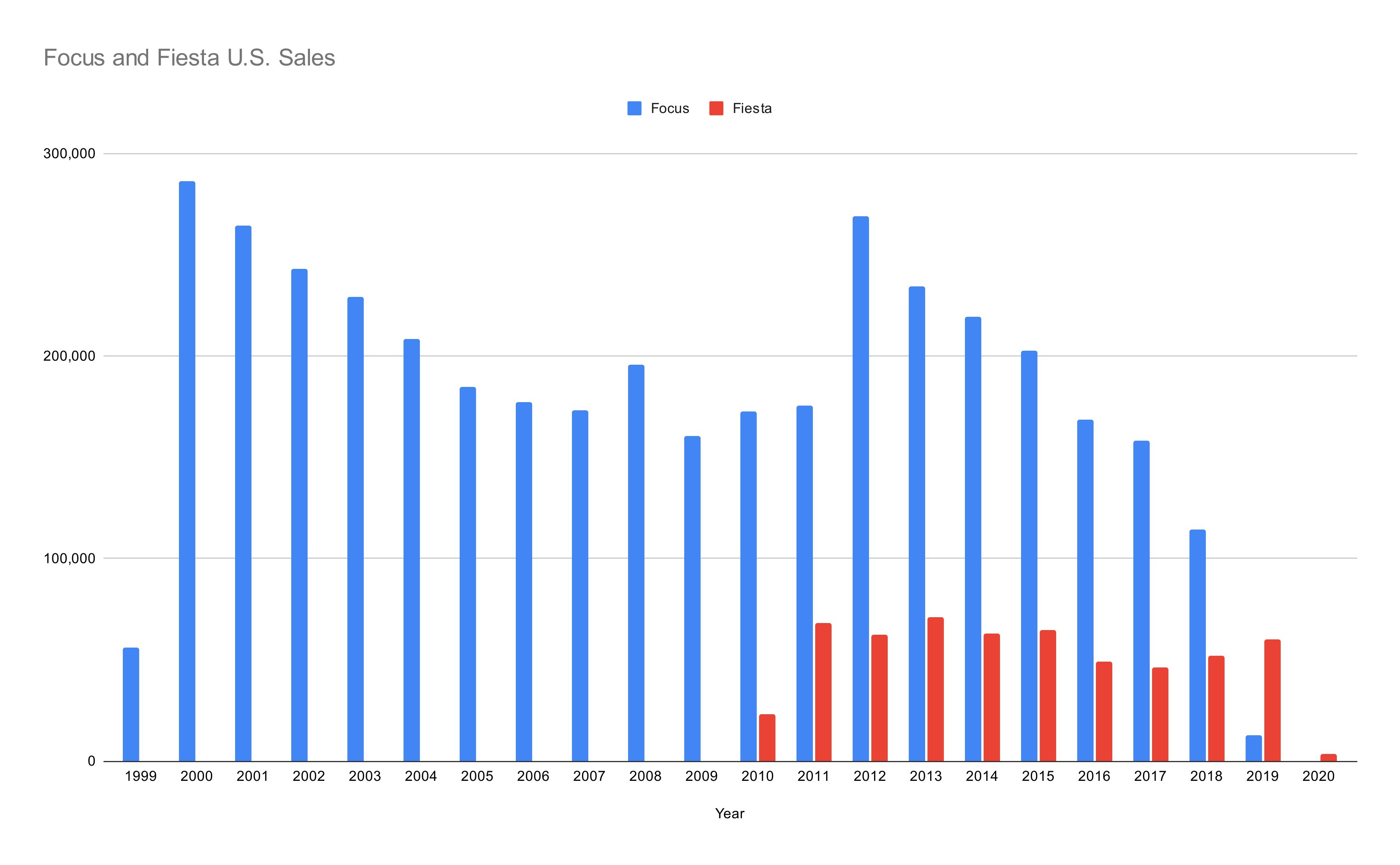

Subcompact cars have never sold in high volumes in the U.S., but Fiesta volumes remained steady from 2010 to 2019. The Fiesta peaked in 2013 at 71,073 units, falling to its worst full year in 2017 at 46,249 units before rebounding to 60,148 in 2019, its last full year. Ford sold the Focus for much longer, hitting its sales peak in 2000 at 286,166 units. Sales dipped below 200,000 units from 2005 to 2011 before rebounding to 269,272 units in 2012, the first year of the third-generation model. While the Focus couldn’t maintain that high momentum, it still remained above 114,000 units until its last full year of sales in 2018.

Add CarBuzz to your Google News feed.

Looking at sales of the Maverick, Ford’s smallest pickup truck, it’s clear that American consumers have an appetite for smaller vehicles. Ford sold 77,113 units through the second quarter of 2024, an 81.4% increase from the same period last year. The Maverick is on track to have its best sales year yet, surpassing the 2023 total of 94,058 units.

Related

Ford Maverick outsold Toyota Tacoma in January

Ford sold 12,443 Mavericks in January.

Who else followed Ford?

Ford isn’t alone in the dilemma that resulted from killing off its small sedans and hatchbacks. In General Motors’ case, this affected three models: the Chevrolet Spark, the Sonic, and the Cruze. The Chevrolet Spark never outsold the Fiesta, peaking in 2014 at 39,159 units. The Chevy Sonic was far more competitive, selling 93,518 that same year before sales steadily declined, culminating in its demise in 2020. The Chevy Cruze was the biggest seller of the three by far, nearly matching the Focus’s high of 273,060 units in 2014, and hovering around 142,000 units through 2018. The last Cruze was built in 2019, and Chevy only sold 47,975 that year.

Stellantis may not get the credit it deserves for killing off small models first, but it actually made the move before Ford or GM. The Dodge Dart was the last small model, at least among the group’s American brands. Dodge sold only the Dart from 2012 to 2017, peaking in 2015 at 87,392 units. Chrysler and Ram no longer sell small cars—the Jeep Renegade doesn’t count because it’s a crossover. Fiat tried selling small cars in the U.S. but peaked at just 46,999 units as a brand in 2012, though the brand is offering its last small electric vehicle in the U.S.

Related

The 2024 Fiat 500e arrives in the United States with 118 hp and a price of $ 32,500

It’s the return of the Fiat 500 to American soil, but will it do better the second time around?

Gas prices and inflation fuel small car resurgence

Ford, GM, and Stellantis all justified discontinuing their small models due to falling sales, but did they all make their decisions prematurely? Gas prices have declined since hitting an all-time high in mid-2022, but they are still above pre-pandemic levels. Combined with inflation wreaking havoc on prices, most Americans can no longer afford a new vehicle. This could explain why the few cheap cars that remain, like the Nissan Versa and Mitsubishi Mirage, are seeing a resurgence in sales.

Related

Where have all the $20,000 cars gone? And why are they becoming extinct?

There are several reasons and we discuss them all.

The Versa is the cheapest new car in America, starting at just $16,680. The Mirage isn’t far behind, starting at $16,695. In fact, these are now some of the last cars in America that cost less than $20,000. Sales volumes aren’t huge, but the Versa’s 17,812 units through the first half of 2024 was a 61.7% increase compared to the same period in 2023. Nissan also saw its compact Sentra grow, up 55% to 89,028 units. The Mirage sold 9,862 units in that time, up 85.6% compared to 2023, despite reports claiming it would be discontinued last year.

We can see similar trends across other automakers when looking at second-quarter sales. The Toyota Corolla is up 25.1% year-to-date (121,991 units), the Honda Civic is up 38.1% (129,788 units), the Kia Forte is up 13.6% (70,473 units), the Mazda3 is up 17.8% (17,827 units), and the Volkswagen Jetta is up 100.1% (33,532 units). In the compact segment, only the Hyundai Elantra (down 17% to 62,289 units) and the Subaru Impreza (down 22.8% to 14,892 units) have seen sales declines so far in 2024.

Related

Test: The 2024 Mazda 3 Hatchback is very close to being perfect

Mazda has refined the Mazda 3 to greatness, and more improvements are on the horizon.

Small and affordable electric vehicles?

Farley promised that a “skunkworks” team is currently working on a $30,000 EV that will be revealed sometime in 2027. That’s a pretty long wait, and we’ve seen how easily automakers can backtrack on EV pricing due to inflation — just look at the Tesla Cybertruck, the Ford F-150 Lightning, the Chevrolet Silverado EV, and others that came to market at higher prices than originally promised or were later increased in price.

Related

The 2024 Chevrolet Silverado EV’s $40,000 price promise has been broken

The cheapest model will now cost around $50,000.

Consumers clearly have an appetite for affordable EVs, as evidenced by the fact that the Chevrolet Bolt EV had its best sales year ever in 2023 (62,044 units). Sadly, this didn’t stop GM from discontinuing it last year. Chevy will overtake Ford in the low-cost EV segment with the next-generation Bolt, coming in 2025, as well as the potential return of the Spark as a cheap EV for the masses. Here’s hoping automakers realize the mistake of killing off small, affordable cars – there’s clearly still a market for them.