The Income Tax Appellate Tribunal (ITAT) in Ahmedabad has said that the provision of section 254(2) of the Income Tax Act, 1961 cannot be used to order reversal and scrutiny by the tribunal. The aforesaid provision is believed to be aimed at correcting the error found in the records.

Taxpayer Neetaben Snehalkumar Patel applied to modify the order passed by the court. According to the taxpayer, there was an error in the order. The taxpayer requested that the order passed by the court be reversed and that he be allowed another opportunity to present his matter before the Court after the appeal was again decided.

The department held that no error was apparent on the record in the ITAT order and that the other application was misdirected. The Assessing Officers (AOs) in the assessment order stated that the share liable by the taxpayer was a penny share and that CBDT Circular No. 5/2024 was perfectly applicable to the facts.

The ITAT therefore rejected the taxpayer’s objection to the effect of low taxation. The department held that there was no error in the court’s order.

Read also: Orissa High Court dismisses appeal against ITAT order for denial of tax agency’s recall application

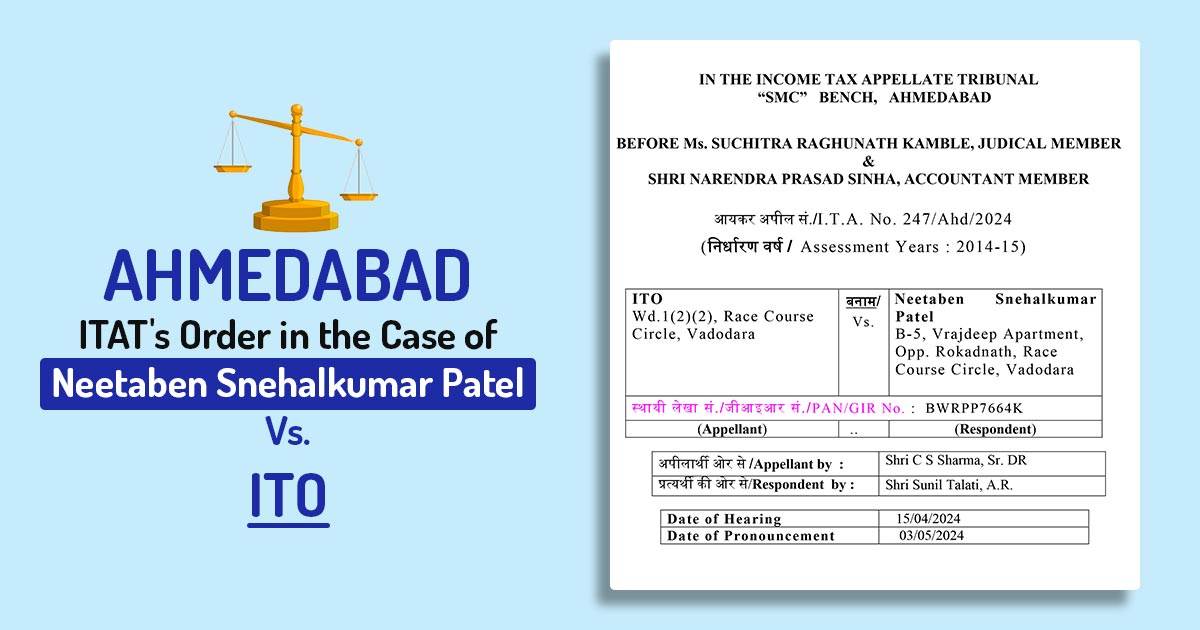

The two-member bench comprising Raghunath Kamble (Judicial Member) and Narendra Prasad Sinha (Accounting Member) has observed that the order passed by the ITAT reversing its earlier order, which was passed in exercise of powers under section 254(2) of the Act, is outside the scope and ambit of the powers of the Appellate Tribunal conferred under section 254(2) of the Income Tax Act, 1961.

The Court, while dismissing the petition, observed that the order issued by the court was not based solely on the portion of the order objected to by the taxpayer. The recorded order of the court is not challenged as erroneous and no error has been pointed out in the orders.

The Income Tax Appellate Tribunal (ITAT) has ruled that there is no need to review its order and examine its merits because the power under Section 254(2A) is restricted to correcting errors found on the record.

| Case title | Neetaben Snehalkumar Patel vs. ILO |

| No case. | ITA No. 247/Ahd/2024 |

| Date | 03.05.2024 |

| Appellant for | Mr. CS Sharma |

| Sued by | Mr. Sunil Talati |

| Ahmedabad Institute of Technology | Reading order |