marekuliasz

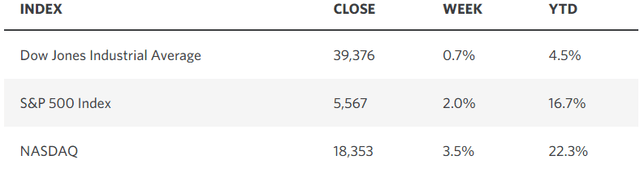

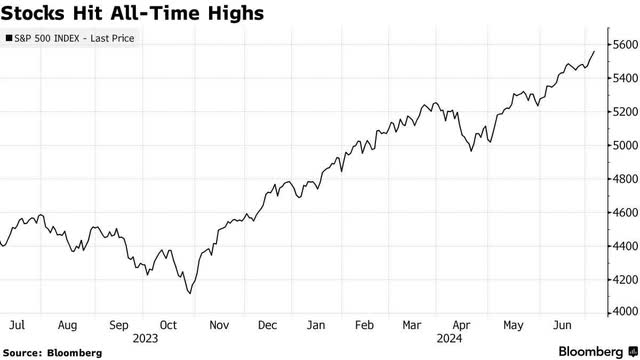

A week ago, I assumed that signs of a weaker labor market and consumer fatigue would raise concerns that the Fed is waiting too long to ease monetary policy, as inflation fears give way to worries about weaker economic growth rates. Growth. While last week’s economic data showed plenty of signs of weakness, investors didn’t seem to be worried as the S&P 500 hit a new all-time high. Bonds rose on the back of the weaker data, pushing long-term yields lower, helping to fuel further gains for the tech sector. Investors may not be worried yet, but I’m on the lookout for a policy mistake as I think the Fed should start cutting rates soon to get ahead of a further slowdown in the rate of economic growth during the second half of this year.

Eduardo Jones

It seems the bond market agrees with me, as two-year Treasury yields fell to a three-month low of 4.61% last week, suggesting the market sees the need for more aggressive monetary easing from the Fed. Still, that’s no guarantee the central bank will follow through on its promise. Chairman Powell and Fed officials have only one rate cut in their Summary of Economic Projections for the remainder of 2024, and they prefer to keep investors guessing when that might change to avoid fueling investor enthusiasm for risk assets. I think three rate cuts this year starting no later than September would be enough to prolong the expansion, but anything less may put that outcome at risk. As I’ve noted for months, soft landings are balancing acts between just the right mix of economic weakness to tame inflation and strength to sustain growth. I’m much more worried about growth now.

Bloomberg

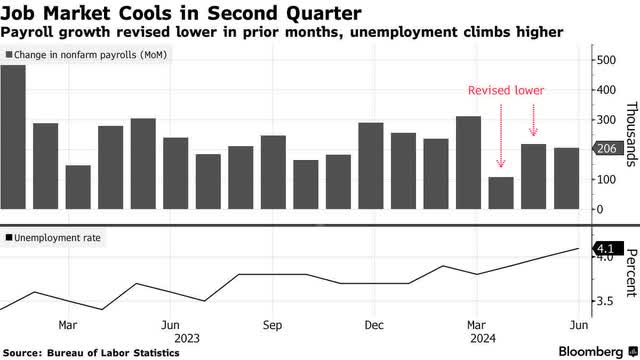

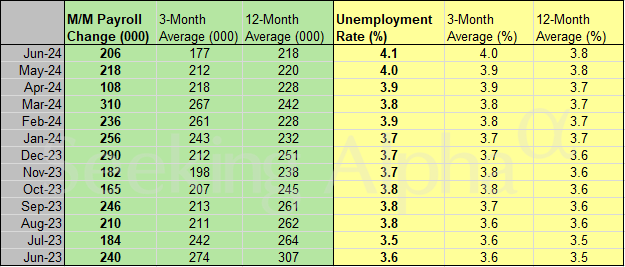

I don’t think it’s necessary for labor market conditions to soften further to meet our inflation target. All indicators in last week’s employment report are weakening. The quarterly average of monthly payrolls has fallen to 177,000, which is likely still an overestimate. Wage growth has fallen to its lowest level in three years. Weekly claims and continuing claims are rising. Revisions to prior months are largely downward.

Bloomberg

For now, I am not worried about the weakening labor market. I think the unemployment rate is rising because more workers are entering the labor force, rather than because there is a sharp rise in the number of unemployed. According to Sahm’s rule, we have not yet received a recession warning from the unemployment rate, since the three-month average rate (4.0%) is not 0.5% or more higher than the previous 12-month low of 3.6%. If that were to happen, it would be cause for concern.

Market clock

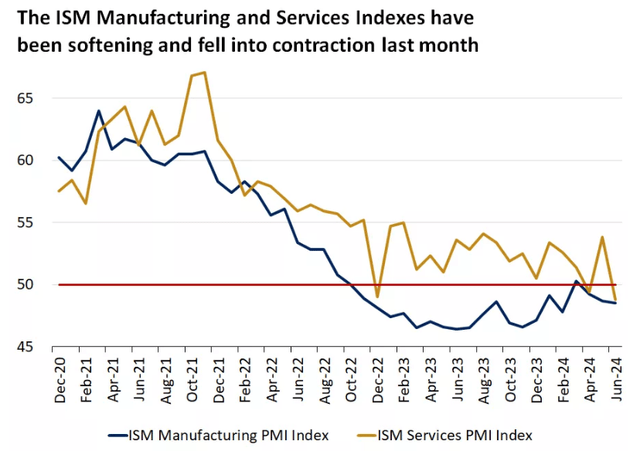

The Institute for Supply Management (ISM) monthly surveys of purchasing managers in both the manufacturing and service sectors indicate a contraction, but it is the service sector that is most noticeable, as it accounts for the majority of our economic activity. This should be a signal for the Fed to start taking its foot off the brake on economic activity. I would be much more concerned if a similar survey from S&P Global indicated a contraction, but it is in expansionary territory and has strengthened over the past three months. Still, the combination of the two is telling the Fed to act.

Edward Jones

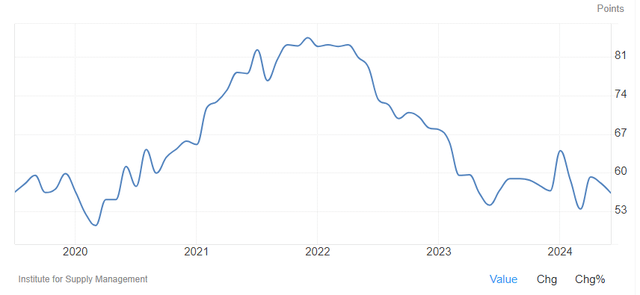

In addition, the ISM’s prices paid index has fallen to pre-pandemic levels, indicating that inflationary pressures for service sector firms are easing. This sub-index leads consumer prices and is telling the Fed that disinflation should continue from what is already a 2.6% rate for its preferred inflation gauge.

Economics of trade

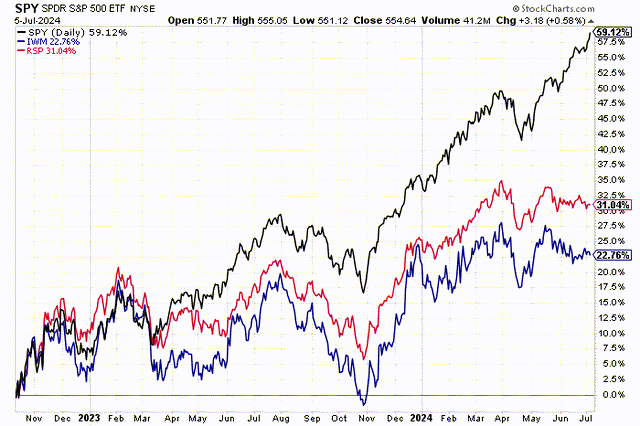

Investors remain optimistic, but they are doing so because of the perceived safety of the largest tech stocks, which is why the cap-weighted S&P 500 (SPY) has significantly outperformed the equal-weighted index (RSP) and the Russell 2000 small-cap index (IWM) since the bull market began in October 2022. This has given bears hope that the uptrend is actually a facade, but I think the lag in performance in most stocks is simply due to investors waiting for confirmation that the US economy has landed softly. If it does, as I continue to expect, I think we will see this performance spread narrow dramatically.

Stock Charts

In that sense, this bull market is extremely young and there are still huge opportunities to be exploited, but the Fed must act soon to ensure that the expansion continues.